- Troy High School

- Financial Aid

Counseling

Page Navigation

- Counseling

- 2025 Senior Reflections and Awards

- How to See Your Counselor

- Course Registration & Course Profiles

- College & Career Center

- Personal/Emotional Health Resources

- AP, PSAT, SAT & ACT

- College/University Information

- Financial Aid

- Graduation Requirements

- Internships and Mentors

- NCAA, NAIA, & NJCAA Eligibility Center

- NOCE (North Orange County Continuing Education)

- R.O.P.

- Summer Enrichment/Pre-College Programs

- Transcripts

- Troy Tutoring Services

- Volunteer Opportunities

- Incoming Freshman Family Resources

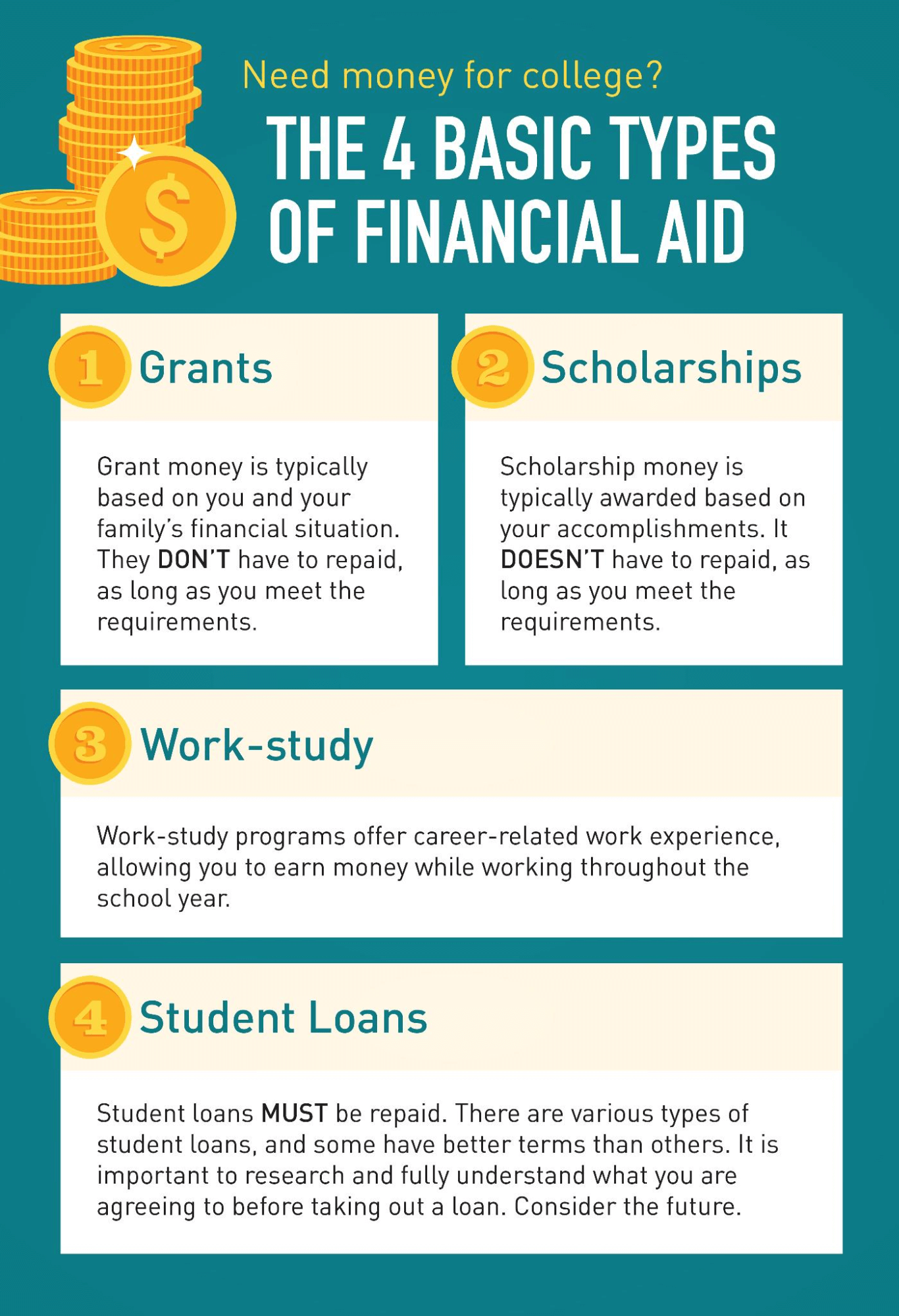

Types of Financial Aid

-

A variety of financial aid sources are available to help you pay for college or career school:

Grants

A grant is a form of financial aid that doesn’t have to be repaid (unless, for example, you withdraw from school and owe a refund, or you receive a TEACH Grant and don’t complete your service obligation). A variety of federal grants are available, including Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Teacher Education Assistance for College and Higher Education (TEACH) Grants, and Iraq and Afghanistan Service Grant.

Scholarships

Many nonprofit and private organizations offer scholarships to help students pay for college or career school. This type of free money, which is sometimes based on academic merit, talent, or a particular area of study, can make a real difference in helping you manage your education expenses.

Work-Study Jobs

The Federal Work-Study Program allows you to earn money to pay for school by working part-time.

Loans

When you receive a student loan, you are borrowing money to attend a college or career school. You must repay the loan as well as interest that accrues. It is important to understand your repayment options so you can successfully repay your loan.

Aid for Military Families

There are special aid programs or additional aid eligibility for serving in the military or for being the spouse or child of a veteran.

Aid for International Study

Federal student aid may be available for studying at a school outside the United States, whether you’re studying abroad or getting your degree from an international school.\

Aid and Other Resources From the Federal Government

Besides aid from the U.S. Department of Education (ED), the federal government offers a number of other financial aid programs. These programs include

-

educational and training vouchers for current and former foster care youth; and/or

-

https://nhsc.hrsa.gov/scholarships and loan repayment programs through the Department of Health and Human Services’ Indian Health Service, National Institutes of Health, and National Health Service Corps.

Aid From Your State Government

Other than federal aid, you might be eligible for financial assistance from your state. Contact your state grant agency for more information.

Aid From Your College or Career School

Many schools offer financial aid from their own grant and/or scholarship funds. Find out what might be available to you:

-

Visit your school’s financial aid page on its website, or contact the financial aid office.

-

Ask at the department that offers your course of study; they might have a scholarship for students in your major.

-

Fill out any applications your school requires for its own aid programs, and meet your school’s deadlines.